Source: https://www.flickr.com/photos/southbeachcars/36475628760

Source: https://www.flickr.com/photos/southbeachcars/36475628760

On June 15, 2017, my phone showed a news alert that Amazon had agreed to buy Whole Foods. I was not anticipating this and it inspired my imagination, as it did for millions of others who took to social media to talk about it.

Jeff Bezos: “Alexa, buy me something from Whole Foods.”

Alexa: “Sure, Jeff. Buying Whole Foods now.”

Jeff Bezos: “WHA- ahh go ahead.” pic.twitter.com/GuJ2jlAiuU

— JESAL (@JesalTV) June 16, 2017

No one knew what Amazon would do with its largest entrance yet into bricks and mortar retailing. The deal closed in August and Whole Foods received a flurry of attention that focused on an announcement that the chain would cut prices on some top sellers like avocados, almond butter, and rotisserie chicken.

My industry colleagues and I frequently talk about the reinvention of Whole Foods. It left me wondering what the average consumer thinks about the new Whole Foods.

So, Revenue Architects conducted a survey in February 2018 to assess changing consumer perceptions toward Whole Foods.

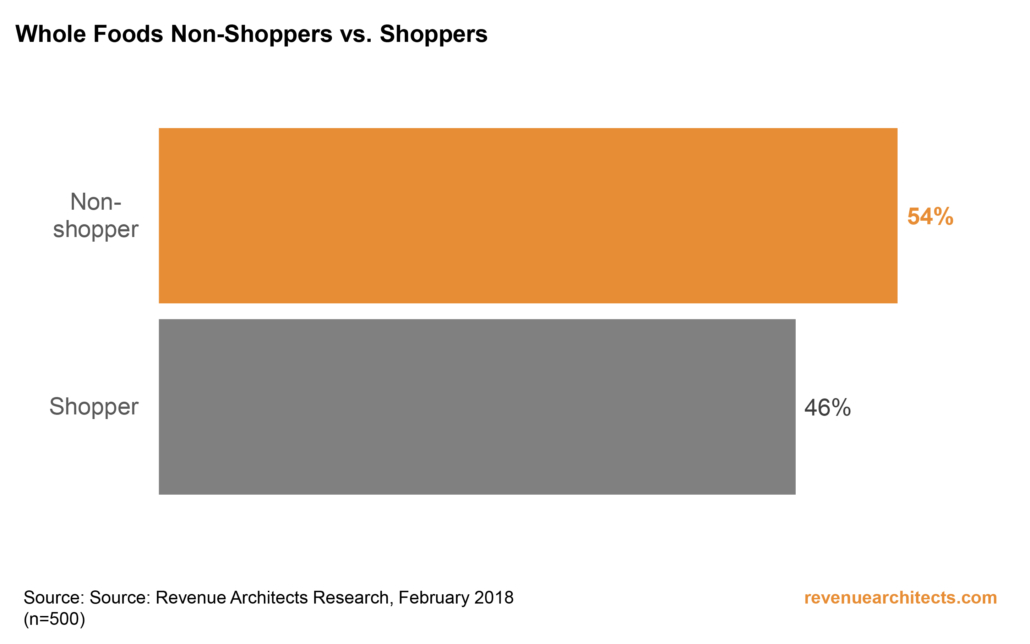

Most notably, most consumers surveyed (54 percent) don’t ever shop at Whole Foods. Many consumers avoid Whole Foods because of a perception that its prices are very high or because they are seeking a broader, more conventional selection of goods. In addition, Whole Foods has only about 470 stores, far from covering the entire United States. By comparison, Walmart has over 4,700 stores and Kroger’s retail brands have nearly 2,800 stores.

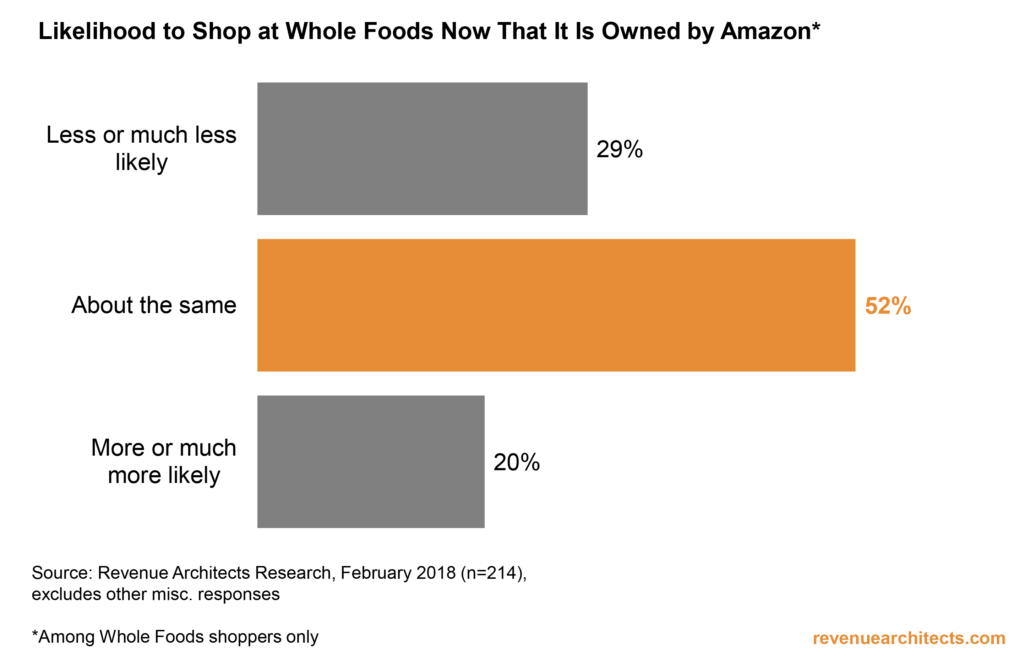

When we focus just on those who do shop at Whole Foods, most of them (52 percent) won’t be changing their shopping behavior because of the Amazon purchase.

A notable portion of the survey respondents say they are less likely or much less likely to shop at Whole Foods now, and it will be important to track whether and in what way the spending of those shoppers is migrating. Some have hypothesized that dedicated organic shoppers might be wary that Amazon will stray from Whole Foods’ product standards, a departure that seems possible after a report that Amazon’s management is interested in adding popular, high-volume, conventional products like Coca-Cola to its shelves.

An almost equal portion of shoppers, though, say they are more likely or much more likely to shop at Whole Foods now, possibly inspired by the innovation and lower prices that Amazon might bring to the chain.

What is abundantly clear, though, is that Amazon has invested considerable sums into dominating online retail, and that they are actively seeking ways to bring innovation to traditional bricks and mortar retail.

Importantly for manufacturers who sell to and aspire to sell to Whole Foods and Amazon: Have you created a plan to address these coming changes?